how to pay indiana state withholding tax

INtax supports the following tax types. If the business cannot locate the REG-1 form you may call us at 317-232-2240 Monday through Friday 8 am430 pm ET.

A Basic Overview Of Indiana S Wh 4 Form For State Tax Withholding

Some of the expenses and types of income that may be deducted in.

. The DORs INtax system or electronic funds transfer EFT. As an employer you must match this tax dollar-for-dollar. Find Indiana tax forms.

Apply online using the IN BT-1Online Application and receive a Taxpayer ID number in 2-3business days. Withholding payments must be made to DOR by the due dates or penalties and interest will be assessed. You must also match this tax.

State Tax to Withhold 61731 x 0323 1994 County Tax to Withhold 61731 x 01 617 Note. For Medicare tax withhold 145 of each employees taxable wages until they have earned 200000 in the 2022 tax year. Indiana tax calculator is an easy tool for computing the amount of withholding tax on your salary income.

Overview of Indiana Taxes. The aggregate of Indian state income tax and local tax applicable in a county within the state of Indiana are taken along with the allowed personal exemption and exemption for dependentsYou can also check federal paycheck tax calculator. INtax is a product of the Indiana Department of Revenue.

You may copy and paste this number directly into Zenefits hyphen included. INTIME now offers the ability to manage all tax accounts in one convenient location 247. DORs new e-service portal at intimedoringov.

All 92 counties in the Hoosier State also charge local taxes. Subtract the withheld taxes from your predicted tax bill to arrive at your final tax bill. Make a payment in person at one of DORs district offices using cash exact change only personal or cashiers check money order and debitcredit cards fees apply Call DOR Customer Service and make a payment over the phone using your debitcredit card fees apply.

You can also find an existing Taxpayer ID Number. After the tax bill is paid in full the business must file a REG-1 form that is mailed to the business. If you do not file a return and pay the proper amount of tax you will face criminal prosecution for fraud or tax evasion.

There is no standard deduction in Indiana but taxpayers may still claim itemized deductions on their Indiana state income tax return. Income Tax Information Bulletins which may be of assistance with withholding tax questions are numbers 16 32 33 and 52. Up to 25 cash back Formerly many Indiana withholding tax payers could pay on paper by sending in Form WH-1 Indiana Employers Withholding Tax Return with a check.

Indiana businesses have to pay taxes at the state and federal levels. You will need to withhold this amount from your paychecks for the remainder of the year in order to closely match your projected tax due. These local taxes could bring your total Indiana income tax rate to over 600 depending on where you live.

Send in a payment by the due date with a check or money order. However as of 2013 all Indiana withholding tax payments and WH-1s must be filed electronically. You may find them at wwwingovdorlegal-resourcestax-libraryinformation-bulletinsincome-tax-information-bulletins.

Additional tax registration may be necessary if your business. You can find your amount due and pay online using the intimedoringov electronic payment system. This will be your Location ID as listed on your Withholding Summary.

If an employee resides out of state on January 1 but has his or her principal place of work or business in an Indiana county the withholding agent should withhold for. Sells food and beverages. Take the renters deduction.

Indiana tax calculator is an easy tool for computing the amount of withholding tax on your salary income. Departmental Notice 1 explains how to withhold taxes on employees. This includes filing returns making payments setting up payment plans viewing refund amounts and secure messaging with DOR customer.

INBiz can help you manage business tax obligations for Indiana retail sales withholding out-of-state sales gasoline use taxes and metered pump sales as well as tire fees fuel taxes wireless prepaid fees food and beverage taxes and county innkeepers. Have more time to file my taxes and I think I will owe the Department. Pay my tax bill in installments.

Accessing from Employee Center. Know when I will receive my tax refund. You have two options for electronic payments.

Claim a gambling loss on my Indiana return. Pay Taxes Electronically The Indiana Department of Revenue DOR offers multiple options to securely remit taxes electronically using DORs e-services portal INTIME and via Electronic Funds Transfer EFT. Indiana counties local tax rates range from 050 to 290.

File my taxes as an Indiana resident while I am in the military but my spouse is not an Indiana resident. For Medicare tax withhold 145 of each employees taxable wages until they have earned 200000 in the 2022 tax year. Using a preprinted estimated tax voucher that is issued by the Indiana Department of Revenue DOR for taxpayers with a history of paying estimated tax.

If you are required to withhold federal taxes then you must also withhold Indiana state and county taxes. Taxes should be withheld from a taxpayers paychecks throughout the year at a rate equal to the total of the state and county rate but youll still need to file a state income tax return. For the feds.

For Social Security tax withhold 62 of each employees taxable wages until they have earned 147000 in the 2022 tax year. The county tax rate will depend on where the employee resided as of January 1. Indiana has a flat tax rate meaning youre taxed at the same 323 rate regardless of your income level or filing status.

Dor Make Estimated Tax Payments Electronically

Annuitants Request For State Income Tax Withholding Wh 4p Indiana

Dor Owe State Taxes Here Are Your Payment Options

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation

Purdue University Degree Pu Diploma Buy Fake Purdue University Degree Buy Fake Pu Diploma University Degree Free Certificate Templates Usa University

Dor Indiana S Tax Dollars At Work

State W 4 Form Detailed Withholding Forms By State Chart

A Basic Overview Of Indiana S Wh 4 Form For State Tax Withholding

Solved Indiana Withholding Setup In Quickbooks Payroll

State W 4 Form Detailed Withholding Forms By State Chart

State Tax Rates 2022 What Numbers Determine Your Contributions Marca

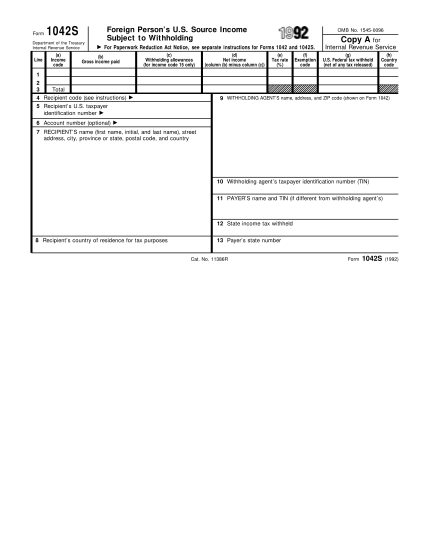

How Taxes Work Taxes Social Security Numbers Visas Employment Office Of International Affairs Indiana University Purdue University Indianapolis

A Complete Guide To Indiana Payroll Taxes

Indiana Tax Id Online Application How To Apply For A Tax Id Ein Online Business Learning Center

Indiana Taxes For New Employees Asap Payroll Services

16 Indiana State Tax Withholding Form Free To Edit Download Print Cocodoc

Can I Print My Own Payroll Checks On Blank Check Stock Welcome To 1099 Etc Com Payroll Checks Printing Software Writing Software